By Shari Johnson, Publisher

A few days ago, I set in my mind that I would square away the Health Insurance of our family 2026. Hearing all the chatter on the news and social media regarding the WV Marketplace seeing a significant increase I was prepared… or so I thought. I plugged all my information into the Marketplace website and hit return with only a slight knot in my stomach. Until the total hit the screen and the knot went to a wave of nausea.

Our new policy which was the same policy for which I paid less than a $1,000 a month, went to over $5,000 monthly. I kid you not. My first reaction was panic. How in the heck could any family justify paying (if they even could) $5,000 a month for health insurance?! After panic came the reality that I could not under any circumstances pay $5,000 a month for insurance.

David and I are both on several medications each month, as we’ve aged we’ve had increased health issues and now my mental health is on the verge of breaking down with the stress of this insurance. Once I got a grip on the fact that I had to deal with this, I began looking for alternatives in the private insurance sector. I really didn’t think the end result would lead to affordable insurance, but it did. Because 63 is not a good age to have children, we don’t struggle with substance abuse and our mental health is nothing treatment would help; taking those issues off the table of necessity dropped our insurance $4,000. Now, where is the logic with Marketplace, and why are they being allowed to railroad people with jacked up insurance rates?

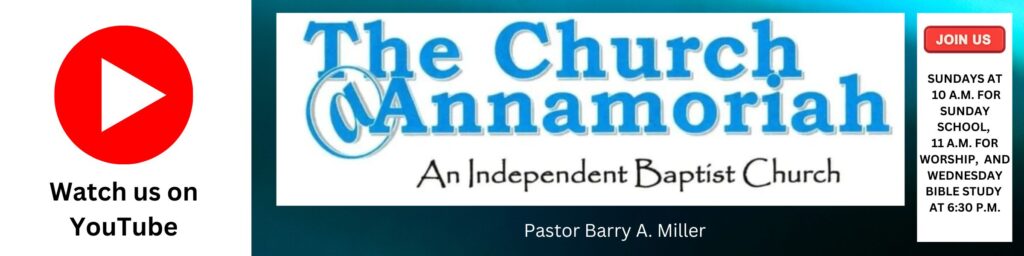

West Virginia’s ACA Marketplace is seeing significant price hikes for 2026 according to the internet news which said that insurers like Highmark took a 13.9% increase. Highmark was our insurer for 2025. But it didn’t take a 13.9% increase, it took a 566.7% increase according to my calculations. (I always tell you math is not my strong suit) but according to the instructions below, the number is correct.

The price increase was said to be because of healthcare costs, drug prices, and inflation. Regardless of the stated reasoning, it boils down to the fact that the industry is out of control and so is the Government.

Why the Big Jump?

- High WV Costs: West Virginia already has some of the nation’s highest commercial healthcare costs, making it disproportionately affected.

- Expiring Subsidies: The enhanced premium tax credits from the American Rescue Plan are ending, and Congress hasn’t extended them.

- Inflation & Drugs: General inflation and rising costs of new, expensive medications (like GLP-1s) also drive up costs.

What to Do

To address high insurance rates, contact your State Insurance Commissioner’s Office, as they regulate insurers and handle consumer complaints for issues like rates, claims, and policy service; in West Virginia, that’s the WV Offices of the Insurance Commissioner, while the federal FIO monitors markets but states regulate directly. You can usually file complaints online or by form with your state’s specific office.

The next election will be another place to make your complaint known.

This isn’t a Marketplace mystery. Your premium didn’t jump 566% because insurers suddenly lost their minds. It jumped because ACA subsidies expired. The 13.9% figure applies to base rates, not what people pay after subsidies. When the help disappears, the math changes.

The Marketplace didn’t “lose logic.” It’s doing exactly what happens when affordability protections are allowed to lapse. A political choice, not a system failure.

And finding cheaper private insurance only after dropping mental health and substance use coverage isn’t proof the Marketplace is broken. That’s medical underwriting. It’s cheaper because it covers less and can deny care later. The very thing the ACA was designed to prevent.

This isn’t railroading. It’s policy consequences finally showing up on a bill. This is exactly what YOU voted for!